The Financial & Health Hazards of Medicare Advantage

August 16, 2021

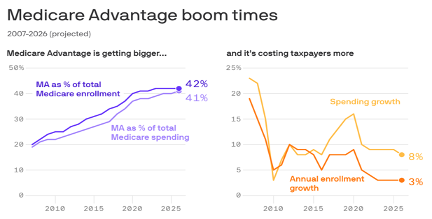

Medicare Advantage Boom Times

Axios

August 11, 2021

By Bob Herman

“Medicare Advantage continued to grow during the pandemic, and it’s increasingly likely a majority of all Medicare enrollees will be in private plans in a few years despite Medicare Advantage’s deep, longstanding problems…

The federal government paid almost $350 billion to MA insurers for this year, a 10% increase from 2020. Every year since 2015, annual spending growth on MA plans has outpaced annual enrollment growth…

Medicare Advantage is consuming more membership and more of the Medicare trust fund, but many enrollees are not sticking with their plans until the end.”

***

Comment by: Isabel Ostrer

Enrollment in Medicare Advantage (MA) is soaring. Why is this a problem? For starters, the program is costly (for both patients and the government). But perhaps more importantly, access to care is severely restricted.

Upfront, it appears that MA plans offer a better financial deal to seniors than traditional Medicare does. Because there are no limits on out-of-pocket spending in traditional Medicare, beneficiaries often buy Medigap policies to the tune of about $2000 per year to buffer against unforeseen costs. MA plans appear to offer a financially viable alternative with low monthly fees and annual limits. But the reality is quite different. The out-of-pocket maximum in 2021 is a whopping $7550. And, according to a recent KFF report, over half of MA enrollees would be on the hook for more money than their traditional Medicare counterparts for a 6-day hospital stay. As we pointed out recently in HJM, this means sick enrollees face major financial barriers.

It’s not just patients who pay big prices for MA – the federal government does too. As Herman points out in his Axios piece, the federal government is seeing large year over year increases in the amount they owe MA insurers. This is a lucrative business for insurers. With annual gross margins that are nearly double the margins in individual and group markets, it’s no wonder new MA insurers are popping up left and right.

But Medicare Advantage isn’t just costly, it’s also deadly. A recent Government Accountability Office report found that MA beneficiaries in the last year of life disproportionately disenrolled to join traditional Medicare. As Eagan Kemp wrote in a recent HJM piece, “Medicare Advantage plans — as they also do with other high-cost patients in poor health — are finding ways to avoid paying the high costs of end-of-life care. They often do this through limiting access to specialized care through narrow networks or other unscrupulous means.”

Private insurers should not exist in Medicare, plain and simple.

You might also be interested in...

Recent and Related Posts

Premier Medical Journal Scrutinizes Corporatization of US Health Care

Laying out the Ill-Effects of Medicaid Cuts in the Congressional Budget Bill