PPO becomes PP-No: Providers Refuse Medicare Advantage

Hospitals and provider systems are increasingly opting out of Medicare Advantage (MA) networks, frustrated by low payment rates and rising payment denials. Even “preferred provider” MA plans, which should cover any Medicare provider, are being declined by prestigious health systems.

December 2, 2023

Hospital Vitals: Financial and Operational Trends

U.S. hospitals face diminished reserves, mounting reimbursement challenges

Syntellis and American Hospital Association

November 2023

Seniors Scramble as Scripps, Other Health Systems Terminate Medicare Advantage Plans

Times of San Diego

November 2, 2023

By Mark Miller • Reuters

Scripps Health, a major Southern California healthcare provider, announced in September that beginning next year, its popular clinic and coastal medical groups will no longer accept patients enrolled in Medicare Advantage, the managed-care alternative to traditional Medicare offered by commercial insurance companies. That has left 32,000 San Diego seniors rushing to find either new healthcare options or new insurance for 2024.

Disabled people who qualify for Medicare before they turn 65 also are affected. And Scripps is not alone — at least a half-dozen other health systems around the U.S. are terminating Advantage contracts.

… [T]he Scripps Health decision underscores an important downside to Medicare Advantage plans: there is no guarantee that you will be able to stick with your preferred doctors and hospitals. Medicare Advantage plans can drop healthcare providers from their networks — and that happens when providers and insurers cannot agree on contract terms.

Last week Scripps Health CEO and President Chris Van Gorder told Reuters that his institution is on track to lose $75 million or more on care it provides to Medicare Advantage patients this year. The two key issues that led to the decision to stop working with advantage plans, he said, were the rates insurance companies were willing to pay, and the tendency of sicker patients to seek treatment at top-notch medical centers such as those run by Scripps.

He said that Scripps also has struggled with the administrative burden of dealing with Medicare Advantage “prior authorization” procedures — essentially, a process where an insurance company determines if it will cover a prescribed procedure, service or drug.

Comment by: Jim Kahn

The Medicare Advantage vs. provider battle is ratcheting up. For decades, providers and managed care insurers maneuvered for market position and vigorously negotiated reimbursement rates for “in network” care. Providers with loyal patients obtained higher payments, and those needing patients settled for less; similarly, insurers with large market share could drive tougher bargains. Mergers in both realms shifted power and payment levels over time.

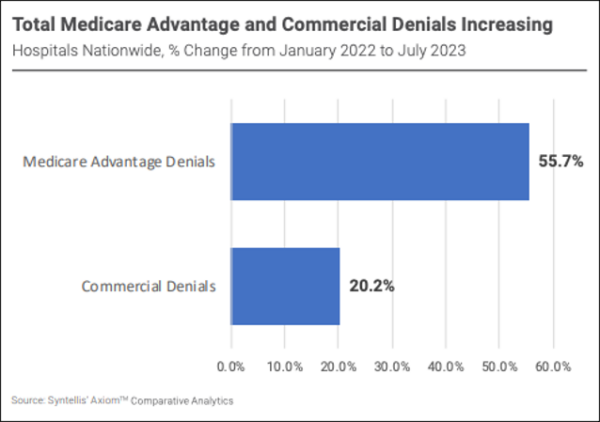

Now, Medicare Advantage plans, ever on the prowl for new ways to raise income and profits, are clamping down on payment, with big jumps in denials and delays. As a result, prestigious providers like Scripps are declining Medicare Advantage; quite a few examples listed here.

I have personal experience with how this phenomenon affects coverage even beyond limited provider networks. I’m insured by Medicare Advantage, despite my many misgivings about MA, because the University of California retirement system offers no way for me to be on traditional Medicare while still insuring the rest of my family (a topic for another day). My MA plan is a “preferred provider organization” (PPO). This means I can see any provider who participates in Medicare and agrees to accept my MA-PPO. For years this worked terrifically well, providing me untrammeled access to top notch Bay Area providers. But recently, a highly regarded academic medical center announced a failure to reach contractual agreement with my MA company. I investigated; reading between the lines, it’s all about money: rates are too low and payment hassles and denials are too high. PPO became PP-No.

Thus, Medicare Advantage increasingly butts heads with the best providers. I’m not taking sides … both insurers and health systems suffer from “profit obsession syndrome” (POS, my own clever name). Yet I do know that this dynamic bodes poorly for access to optimal care, meaning compromised clinical outcomes.

Whereas if we had single payer, hospitals would be paid with reliable global budgets, and reimbursement levels would be standard and fair. Every ideal patient-provider match would be possible. Health would be maximized. Isn’t that what it’s about?

About the Commentator, Jim Kahn

Jim (James G.) Kahn, MD, MPH (editor) is an Emeritus Professor of Health Policy, Epidemiology, and Global Health at the University of California, San Francisco. His work focuses on the cost and effectiveness of prevention and treatment interventions in low and middle income countries, and on single payer economics in the U.S. He has studied, advocated, and educated on single payer since the 1994 campaign for Prop 186 in California, including two years as chair of Physicians for a National Health Program California.

See All PostsYou might also be interested in...

Recent and Related Posts

Public Provisioning of Services: Adjunct to Single Payer