Medicare Advantage Worsens Coverage

A national survey of Medicare beneficiaries quantifies the coverage experience. Bottom line: Medicare Advantage (MA) underperforms traditional Medicare for most metrics. MA has more care delays and financial barriers, and similar care coordination burden, despite massive overpayment of MA plans.

March 6, 2024

What Do Medicare Beneficiaries Value About Their Coverage?

Findings from the Commonwealth Fund 2024 Value of Medicare Survey

February 22, 2024

By Gretchen Jacobson et al.

Survey Highlights

- Whether enrolled in Medicare Advantage or traditional Medicare, about two in three beneficiaries overall said their coverage has fully met their expectations. Those who said it fell short of expectations pointed to a lack of coverage for needed services, high costs, or uncertainty about what benefits are covered.

- Larger shares of beneficiaries in MA plans than in traditional Medicare reported they experienced delays in getting care because of the need to obtain prior approval (22% vs. 13%) and couldn’t afford care because of copayments or deductibles (12% vs. 7%). By other metrics, access to needed health care was similar. For example, more than a third of beneficiaries in each type of Medicare coverage said they had to wait over a month to see a doctor.

- Three in five beneficiaries in MA plans and one-quarter in traditional Medicare said they were asked to undergo a health assessment, which most frequently resulted in a discussion with their doctor. Few said it resulted in any changes to their care plan or in more services or benefits being offered.

- Seven in 10 beneficiaries in MA said they used some of their plan’s supplemental benefits in the past year; three in 10 did not use any. Four in 10 reported using their dental or vision benefits or an allowance for over-the-counter medications.

Administrative Burdens

Getting medical bills paid by their Medicare plan is one of the often time-consuming administrative tasks that beneficiaries must handle themselves. A somewhat larger share of beneficiaries in MA plans compared to traditional Medicare reported a delay in getting health care in the past 12 months because of administrative paperwork (9% vs. 6%; data not shown) or difficulty obtaining approval from their Medicare coverage (15% vs. 9%; data not shown).

More dual-eligible beneficiaries in Medicare Advantage than in traditional Medicare said their coverage has fully met their expectations.

Comment by: Jim Kahn

Talking with Medicare beneficiaries is the best way to assess their coverage experience. What we learn is that two-thirds of enrollees are happy with coverage, but one third are dissatisfied due to coverage gaps, costs, and benefit uncertainty.

Importantly, Medicare Advantage (MA) beneficiaries are more likely to experience care delays due to prior approvals and can’t afford care due to out-of-pocket costs. That is, access to care is worse in MA than in traditional Medicare (TM), despite overpayments of about $100 billion per year.

MA enrollees do, however, get more health assessments – 60% vs 25% in TM. Why? Because that’s a tactic that MA plans use to add diagnostic codes to game risk adjusted payments (discussed in our most recent HJM). Typically without “changes to their care plan or more services or benefits”.

Supplemental benefits in MA are used by most, though any particular benefit is not used much.

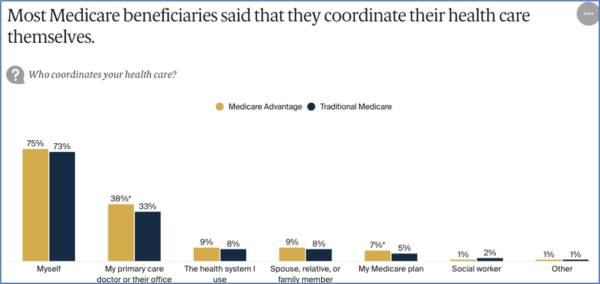

Being in MA increasing the likelihood of care delay due to paperwork and approvals. Strikingly, despite the claim that MA plans integrate care, MA enrollees are just as likely as TM enrollees to coordinate their own care.

One finding favors MA: Among Medicaid-Medicare dual eligibles (typically with complex medical issues), those in MA are a bit happier with coverage than those in TM. Not sure what that’s about, and no explanation is offered.

Overall, negative coverage value for the huge added expense of MA. Time to switch to an (improved) traditional Medicare for All – single payer.

About the Commentator, Jim Kahn

Jim (James G.) Kahn, MD, MPH (editor) is an Emeritus Professor of Health Policy, Epidemiology, and Global Health at the University of California, San Francisco. His work focuses on the cost and effectiveness of prevention and treatment interventions in low and middle income countries, and on single payer economics in the U.S. He has studied, advocated, and educated on single payer since the 1994 campaign for Prop 186 in California, including two years as chair of Physicians for a National Health Program California.

See All PostsYou might also be interested in...

Recent and Related Posts

Premier Medical Journal Scrutinizes Corporatization of US Health Care

Laying out the Ill-Effects of Medicaid Cuts in the Congressional Budget Bill