Estimated US Deaths Associated with Health Insurance / Access to Care

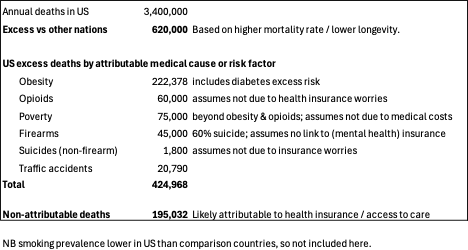

The US has far higher mortality than other wealthy nations. Yet the fraction associated with health insurance issues and impaired access to care is difficult to estimate, due to elevated disease risk factors. This analysis estimates 200,000 annual deaths after adjustment for high-burden US diseases, potentially representing insurance-related mortality.

December 28, 2024

This week, a careful reader asked me to justify this estimate from November 2021: “The US excess mortality age 20-64 is about 1.4 per 1000 per year. Some of that is due to non-insurance factors. If 1.0 per 1000 is attributable to insurance, applied to the 190 million in this age range, that’s 190,000 extra deaths per year.”

In 2021, I was making a rough estimate by assigning most of the inter-country difference among adults 20-64 to health insurance. Perhaps I didn’t sufficiently emphasize the uncertainty of that estimate. Today, to “triangulate”, I took a different approach. I looked up death rates for major risk factors and diagnoses more common in the US than in other wealthy nations. This is not yet sufficiently refined for academic publication, but it’s a solid first cut, so I’m sharing it with HJM readers.

This finding of 195,032 annual deaths not explained by risk factors and diseases more common in the US is close to my prior estimate of 190,000. As noted, several of the totals may actually have medical insurance as a contributing cause – e.g., medical debt forcing people into poverty, or suicides associated with insurance worries or lack of access to mental health care. Thus, the 195,032 is likely a low estimate of insurance-related deaths.

To me, this high mortality burden is consistent with our fragmented and flawed insurance system, with half of adults experiencing financial barriers to care in any given year, often with reported health consequences. Growing rates of care denials are likely increasing the human toll, based on both reports of personal experiences and national surveys of physicians.

These kinds of estimates are imprecise, and indeed the uncertainty bounds are hard to specify. However, they are meaningful despite uncertainty. Whether the excess deaths due to insurance gaps total 195,000 per year, or 220,000, or 170,000, that’s hundreds of thousands too many deaths. The 45,000 estimated in 2009 for those lacking insurance altogether (ignoring under-insurance) is also too much, inexcusable.

We need universal public insurance providing broad benefits to everyone, to save lives and money.

Sources:

Bor J et al. PNAS Nexus 2023 Missing Americans: “Early death in the United States 1933–2021’

Dehry SE et al. Population Research and Policy Review 2023 “Excess Deaths in the United States Compared to 18 Other High‑Income Countries”

Ward ZJ et al. 2022. EClinicalMedicine “Excess mortality associated with elevated body weight in the USA by state and demographic subgroup”

Peterson-KFF Health System Tracker. 2021 “Country Comparison: Prevalence of obesity”

Commonwealth Fund. 2024 “Comparing Deaths from Gun Violence in the U.S. to Other Countries”.

Morbidity and Mortality Weekly Report. 2022 “Motor Vehicle Crash Deaths — United States and 28 Other High-Income Countries, 2015 and 2019”

Roser M. Our World in Data 2020 “Why is life expectancy in the US lower than in other rich countries?”

About the Commentator, Jim Kahn

Jim (James G.) Kahn, MD, MPH (editor) is an Emeritus Professor of Health Policy, Epidemiology, and Global Health at the University of California, San Francisco. His work focuses on the cost and effectiveness of prevention and treatment interventions in low and middle income countries, and on single payer economics in the U.S. He has studied, advocated, and educated on single payer since the 1994 campaign for Prop 186 in California, including two years as chair of Physicians for a National Health Program California.

See All PostsYou might also be interested in...

Recent and Related Posts

Premier Medical Journal Scrutinizes Corporatization of US Health Care

Laying out the Ill-Effects of Medicaid Cuts in the Congressional Budget Bill