Insane Drug Prices & Gaming = Huge Profits for Pharma & PBMs

Two news items this week lay bare US drug cost problems. The underlying cause is prices several-fold higher than elsewhere. Exacerbating that is convoluted gaming – moving money around to boost and retain profits. Who wins? Pharma and Pharmacy Benefit Managers (partnered with insurers). And loses? The rest of us.

May 13, 2023

Senators Call Out PBMs, Drugmakers for High Prescription Drug Costs

MedPage Today

May 11, 2023

By Shannon FirthDrugmakers and pharmacy benefit managers (PBMs) traded the blame over high drug prices during a hearing of the Senate Health, Education, Labor and Pensions Committee on Wednesday.

Each side argued the other was trying to fleece patients and the government, but Sen. Bernie Sanders (I-Vt.), chairman of the committee, argued there was plenty of blame to go around.

“Let’s be clear, while Americans pay outrageously high prices for prescription drugs, the pharmaceutical companies and the PBMs make enormous profits every year,” he said.

In 2021, the 10 major drug companies made $100 billion in profits, and in 2022, the three largest PBMs made over $27 billion, Sanders noted. Moreover, the three pharmaceutical companies that produce insulin — Eli Lilly, Novo Nordisk, and Sanofi — have hiked the price of the drug dozens of times over the last two decades for “the same exact product,” he added.

Meanwhile, 1.3 million Americans have been forced to ration their insulin because of its high cost, and some, including 23-year-old Alec Raeshawn Smith, have died.

…Several lawmakers argued that PBMs benefit from higher list prices because higher prices mean higher rebates, and PBMs keep a portion of rebates. …

In their testimony, the PBM witnesses all stated that they pass about 98% of their rebate onto their customers, which include employers, health plans, and unions. …

Notably, however, because of vertical integration, the three largest PBMs, CVS Health, Express Scripts, and OptumRx … are all owned by or partnered with health plans. UnitedHealth Group owns OptumRx, Cigna owns Express Scripts, and CVS Health and Aetna merged in 2018.

Sen. Markwayne Mullin (R-Okla.) likened this setup to “the fox guarding the henhouse.” He pointed out that when PBMs say 98% of rebates go to customers, health plans are included among their customers.

“So you’re rebating yourselves. That is just — wow — [a] great business model,” he said.

Wonking Out: Attack of the Pharma Phantoms

New York Times

May 12, 2023

By Paul KrugmanThe U.S. health care system, unlike health systems in other countries, isn’t set up to bargain with drug companies for lower prices. In fact, until the Biden administration passed the Inflation Reduction Act, even Medicare was specifically prohibited from negotiating over drug prices. As a result, the U.S. market has long been pharma’s cash cow: On average, prescription drugs cost 2.56 times — 2.56 times — as much here as they do in other countries.

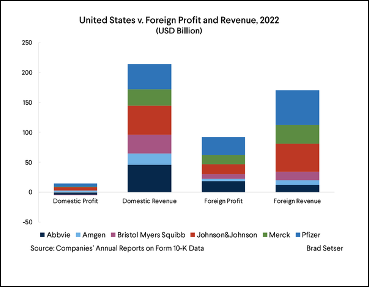

Strange to say, however, pharmaceutical companies report earning hardly any profits on their U.S. sales. … a striking chart comparing 2022 revenue and profit for six major pharma companies:

… 2022 was an exceptionally profitable year for these companies, but the pattern — large revenue in the U.S. market, with very low reported profits — has been consistent over time.

How do the pharma giants do that? Mainly by assigning patents and other forms of intellectual property to overseas subsidiaries located in low-tax jurisdictions. Their U.S. operations then pay large fees to these overseas subsidiaries for the use of this intellectual property, magically causing profits to disappear here and reappear someplace else, where they go largely untaxed.

Comment by: Jim Kahn

These two pieces, a news report on a Senate hearing and an op-ed by a prominent economist, succinctly characterize the massive cost problems we face with prescription drugs.

First, prices are more than 2.5 times as high in the US as in comparison wealthy countries.

Second, drug companies avoid paying US taxes on those profits by setting up intellectual property havens in other countries with low tax rates. They pay themselves (their foreign entities) inflated amounts for patent use, thereby shifting profits to where they can keep them.

Third, PBMs – an invented intermediary structure — manipulate prices and rebate schemes to grab another huge slice of income and profits. The “rebates” are largely to the insurance companies with which they share corporate structure.

Single payer would replace this convoluted profit-maximizing drug marketing maze with a straightforward, proven and transparent system of drug price negotiation and payment. This shift would save enough money, along with administrative simplification, to make single payer the economic unicorn: a “free lunch” — a cost–saving expansion to universal high-quality insurance.

About the Commentator, Jim Kahn

Jim (James G.) Kahn, MD, MPH (editor) is an Emeritus Professor of Health Policy, Epidemiology, and Global Health at the University of California, San Francisco. His work focuses on the cost and effectiveness of prevention and treatment interventions in low and middle income countries, and on single payer economics in the U.S. He has studied, advocated, and educated on single payer since the 1994 campaign for Prop 186 in California, including two years as chair of Physicians for a National Health Program California.

See All PostsYou might also be interested in...

Recent and Related Posts

Premier Medical Journal Scrutinizes Corporatization of US Health Care

Laying out the Ill-Effects of Medicaid Cuts in the Congressional Budget Bill