Modern Medicare vs. Single Payer

Sadly, Medicare has been twisted into a morass of complex choices and financial vulnerability. Coverage in other nations and with single payer is simple and effective. Let’s take that path!

February 21, 2025

Bridging the Medicare Cost Gap: Knowing Your Options

The New York Times

February 15, 2025

By Mark Miller

Medicare can cover most of your health care needs when you turn 65, but it doesn’t pay for everything. And one of the most significant financial challenges to watch out for are the out-of-pocket costs you can face aside from monthly premiums — including deductibles and other types of cost sharing.

Just how much you’ll pay, and when, depends on the type of Medicare enrollment that you choose: traditional Medicare, which is operated by the government and provides care on a fee-for-service basis, or Medicare Advantage, which is run by private insurance companies and operates on a managed care model.

There is no built-in annual out-of-pocket limit in traditional Medicare for outpatient and hospitalization services. Protection is available from supplemental insurance coverage – most often it means purchasing Medigap — a policy offered by private insurance companies that covers part or all of Medicare’s cost-sharing requirements.

Medicare Advantage plans come with out-of-pocket limits — but they can be high. When serious medical conditions arise, out-of-pocket costs can be a significant financial hit or make it difficult to afford care altogether. Medicare Advantage plans offer one-stop shopping and extra benefits, but they restrict care to in-network providers and have been criticized for techniques such as “prior authorization.” Traditional Medicare offers the widest access to health providers, and only a small group of medical services require prior authorization.

Medigap

Buying Medigap can be daunting, since the policies come in an alphabet soup of lettered plan choices (A, B, C, D, F, G, K, L, M and N). Medigap premium prices will differ, but the benefits offered by plans are standardized. All Medigap policies cover hospital coinsurance — the costs that you pay for longer stays after deductibles are met. Many cover all or part of the hospital deductible. Medigap plans also cover all or part of the 20 percent of fees for most physician services. They are required to also cover some or all of the cost sharing for outpatient services, and the more robust plans cover the annual hospital deductible and cost-sharing in skilled nursing facilities.

When you first sign up for Part B, which covers doctor visits and outpatient care, that’s when Medicare forbids Medigap plans from rejecting you. The opportunity is available to you during your six-month Medigap Open Enrollment Period, which starts on the first day of the month in which you’re 65 or older. After this period ends, Medigap plans in most states can reject applications or charge higher premiums because of pre-existing conditions.

Medicare Advantage

Jan. 1 through March 31 — this is the time when people enrolled in Advantage can switch plans or move to traditional Medicare. Before making a decision to move to traditional Medicare, make sure you can obtain a Medigap policy. Once you’ve identified a plan that interests you, contact the insurance company for details. The premium will vary.

High-deductible MediGap G plans are not a well-publicized option since Medigap commissions generally are a percentage of the premium, it incentivizes brokers to sell the G plans with the higher premiums.

With Advantage, the exposure can be high in years when you need lots of health care, and out-of-pocket features in the Advantage program vary by plan. It’s not necessarily true that Medicare Advantage will save you money. “The information is published, but it’s very difficult to compare,” Dr. Tricia Neuman of KFF said. “It’s really on the consumer to try to sort through which plan provides the most or least protection, and that’s tough to do.”

More generally, people enrolled in traditional Medicare with supplemental coverage are the least likely to report problems managing their costs, because they have the greatest level of protection, KFF research shows.

Health Care Affordability for Older Adults: How the U.S. Compares to Other Countries

Commonwealth Fund

December 4, 2024

By Munira Z. Gunja, et al.

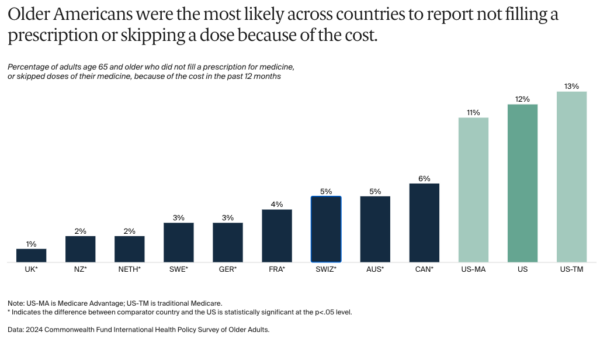

Nearly a quarter of older adults in the U.S. spent at least USD 2,000 over the past year on out-of-pocket expenses, compared to less than 5 percent in France and the Netherlands who spent an equivalent amount.

Comment by: Don McCanne & Jim Kahn

We have long tried to simplify the single payer concept of financing health care by labeling it “Medicare for All,” with the idea that Medicare is a straightforward publicly administered and financed program that serves everyone well. But no longer. These days, it’s a diverse and overwhelming set of options: public traditional Medicare, dozens of supplementary private insurance options (Medigap), and hundreds of private insurance plans (Medicare Advantage) – representing massively complex variation in out-of-pocket costs, benefits, and providers. There is also dual eligibility with Medicaid to assist poor and disabled seniors. Understanding and choosing rationally among Medicare options is impossible.

Simply stated, modern Medicare is a convoluted nightmare that even trained professionals can barely understand. Imagine how intimidated the the average consumer is when receiving reams of information from Medicare, and from private insurers who seek to extract maximum profit from enrollees.

Seniors in other wealthy nations (such as in the OECD) have far superior financial protection for their healthcare, as documented by the recent Commonwealth survey.

What’s behind that success?

- Seniors don’t need to hassle with intimidating choices. They’re just covered, like everyone else.

- The coverage is broad and standard. There are no complex and variable rules about benefits, coverage circumstances, and provider panels.

- Cost-sharing – deductibles especially – is modest. Skipping care for financial reasons is much less frequent, and medical bankruptcy isn’t a phenomenon.

So, we certainly don’t want to keep the current US system with its profoundly complex and expensive administrative excesses that are designed to divert health care funds to wealthy investors while limiting access and choice in health care and leaving millions of people with minimal health care or none at all.

How would US single payer help seniors? Unsurprisingly, it echoes successful foreign practices:

- Streamlined coverage: Standardize and thus radically simplify the process to obtain insurance. Indeed, nothing would change at age 65 – just a continuation of lifelong insurance.

- Reduced financial risk: Cover all necessary medical services, with minimal cost-sharing.

US single payer would be equitably funded by using progressive taxes based on ability to pay, ranging from free for those with very low incomes to more generous funding by our billionaires who would be able to fully maintain their current lifestyles with the riches they would retain. Thus payments into the system would be affordable for all.

We would make health care free or nearly so at the point of service, funding the system through global budgets and other rational economic methods that would fairly compensate providers. Physicians, nurses and other health care professionals would be able to devote all of their time to patient care without worrying about their incomes being based on the amount and intensity of services provided.

Everyone would receive the care they needed. It would be both universal and comprehensive.

It would be publicly administered, eliminating the excessive administrative costs and private profits of our current system.

In opinion polling in the US, two-thirds of adults say “yes” to the following proposition: “Would you support the government paying for all health care, if taxes would rise but premiums and cost-sharing would disappear?” Our online household cost calculators confirm that the vast majority of households would save money with single payer.

In today’s massive political upheaval our beneficial institutions – including public insurance programs — are being threatened. How about affordable, comprehensive health care for all (left and right politically)? Wouldn’t that be a giant step toward making America great?

About the Commentator, Don McCanne

Don McCanne is a retired family practitioner who dedicated the 2nd phase of his career to speaking and writing extensively on single payer and related issues. He served as Physicians for a National Health Program president in 2002 and 2003, then as Senior Health Policy Fellow. For two decades, Don wrote "Quote of the Day", a daily health policy update which inspired HJM.

See All PostsYou might also be interested in...

Recent and Related Posts

Saturday! National Day of Action for Single Payer

GOP Medicaid Cuts: Multifaceted, Severe, Deadly, Machiavellian