ACA Private Plans Financial Barriers Rising

November 10, 2021

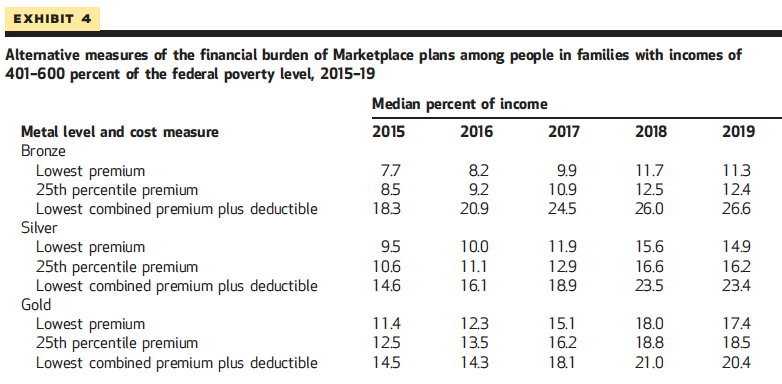

Summary: The Affordable Care Act uses private plan Marketplaces and tax subsidies to try to make insurance affordable for middle class families. New research shows that from 2015-2019, low cost Bronze plans increased in net cost, with combined premiums and deductibles reaching 26.6% of median income. ACA financial protections, already weak, are eroding.

ACA Marketplaces Became Less Affordable Over Time For Many Middle-Class Families, Especially The Near-Elderly

Health Affairs

November 2021

By Paul D. Jacobs and Steven C. Hill

from Abstract:

As a measure of affordability, we calculated potential [Affordable Care Act] Marketplace premiums as a percentage of family income among families with incomes of 401– 600 percent of poverty. In 2015 half of this middle-class population would have paid at least 7.7 percent of their income for the lowest-cost bronze plan; in 2019 they would have paid at least 11.3 percent of their income. By 2019 half of the near-elderly ages 55–64 would have paid at least 18.9 percent of their income for the lowest-cost bronze plan in their area. The American Rescue Plan Act temporarily expanded tax credit eligibility for 2021 and 2022, but our results suggest that families with incomes of 401–600 percent of poverty will again face substantial financial burdens after the temporary subsidies expire.

Comment by: Jim Kahn

A major element of the Affordable Care Act (ACA) was to establish “Marketplaces” or “Exchanges” to facilitate access to regulated private insurance plans for the middle class – those earning too much to qualify for Medicaid, lacking workplace insurance, and not wealthy enough to go it alone.

This strategy has a number of problems. It’s inefficient, just like (even more than) all private health insurance, with administrative and profit costs. It’s a government hand-out to private insurers – after all, the subsidy is really to the insurers, passing through the insured. And the plan designs are flawed, with inconsistent coverage rules and for low-cost plans (Bronze especially) consistently high deductibles.

This new research shows that initially (2015) for families at 400-600% of the Federal Poverty Level (currently $69,680–$104,520 for a family of two), the premium represented 7.7% of income for a Bronze plan, and this reached 18.3% when including the deductible – potentially a significant financial burden and barrier to care. By 2019, these costs rose to 11.3% and 26.6% of income, respectively. For those 55-64 years old, the premium alone is now 18.9% of income.

Sorry for the deluge of geeky percentages. They reflect real financial barriers to insurance and to medical care. The fact that the portion of income is substantial and increasing should add to evidence that the ACA is a flawed overlay patch to our fundamentally dysfunctional health insurance system.

It’s time to end the overlay patches, and adopt a simple, direct, understandable, efficient, and equitable system, one that has been demonstrated to work in dozens of countries around the world. Single payer.

You might also be interested in...

Recent and Related Posts

Premier Medical Journal Scrutinizes Corporatization of US Health Care

Laying out the Ill-Effects of Medicaid Cuts in the Congressional Budget Bill