Demystifying Single Payer

Resources for understanding US health care and how to fix it.

Latest Posts

- Immigrants and Health CareJuly 11, 2025The Trump White House is emphatically pursuing a policy of massive immigrant detention and deportation that is both inhumane and unpopular. It is also profoundly harmful to our well-being: it threatens the backbone of our health care workforce.

- Premier Medical Journal Scrutinizes Corporatization of US Health CareJuly 4, 2025

- Laying out the Ill-Effects of Medicaid Cuts in the Congressional Budget BillJune 27, 2025

- Public Provisioning of Services: Adjunct to Single PayerJune 19, 2025

- Health Reform Review: What’s Breaking, & Breaking ThroughJune 11, 2025

Ai-Chat

Ask questions and have full conversations with HJM, powered by artificial intelligence!

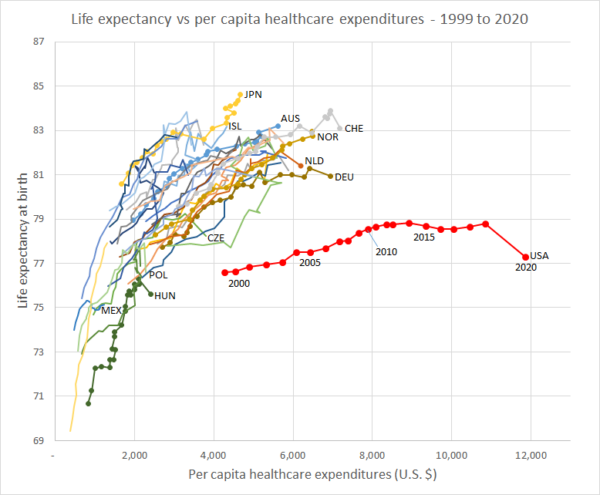

Life Expenctancy vs. Per Capita Healthcare Expenditures (1999 – 2020)

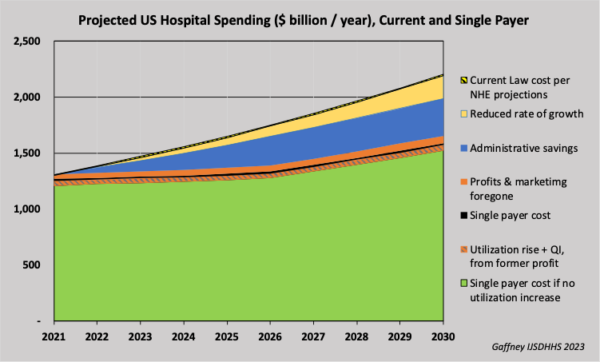

Life Expenctancy vs. Per Capita Healthcare Expenditures (1999 – 2020) Projected U.S. Hospital Spending, Current and Single Payer (2021-2030)

Projected U.S. Hospital Spending, Current and Single Payer (2021-2030)