MA Insurers Reap $60 Billion from Premium Boost & Inflated Diagnoses

The 2026 CMS premium increase and a new study together highlight how Medicare Advantage plans fleece tens of billions from the government. Trump’s CMS raised premiums by $25 billion from Biden-era plans, and diagnostic up-coding generates $33 billion in excess payments annually.

April 13, 2025

Trump’s CMS dramatically raises payments to Medicare Advantage plans

Healthcare Dive

April 8, 2025

By Rebecca Pifer

> The Trump administration handed Medicare Advantage plans a massive gift on Monday, finalizing payment rates for 2026 significantly higher than what regulators in the Biden administration sketched out.

> The 5.1% benchmark increase should accelerate margin recovery for the privatized Medicare plans … Insurer stocks soared [up to 16%] after the payment notice was announced.

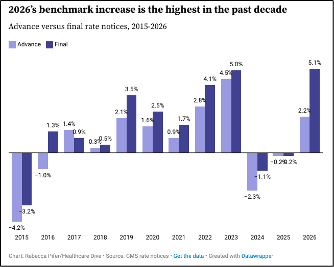

The 5.1% rate increase for MA plans is the largest rate increase in the past decade, and is up significantly from the 2.2% increase proposed by the Biden administration in January.

Overall, it should result in more than $25 billion in additional payments going to MA plans next year, according to the CMS.

However, the real sum will be higher, given the CMS’ estimate doesn’t include the impact of plans’ coding practices. The expected change in revenue for MA plans jumps from 5.1% to 7.2% including the impact of risk scoring.

“This reads very positive” for insurers, Mayo said.

“Overall, we view the [2026] Final notice as a best-case scenario,” Ryan Langston, analyst with TD Cowen, wrote in a Monday note.

Insurer-Level Estimates of Revenue from Differential Coding in Medicare Advantage

Annals of Internal Medicine

April 2025

By Richard Kronick et al.

Background: Medicare Advantage (MA) plans report diagnoses more intensely than providers in traditional Medicare (TM), and there is wide variation in coding intensity across MA plans.

Participants: 697 MA contracts offered by 193 insurers.

Results: In 2021, the average risk score was 1.26 in MA vs 1.07 in TM. … The risk score at UnitedHealth Group was 0.28 higher than it would have been if its plans had coded identically to TM. … Kaiser Permanente coded only slightly more intensely than TM. Due to differential coding, MA plans received an estimated $33 billion in additional payment in 2021, 42% of which went to UnitedHealth.

Comment by: Jim Kahn & Don McCanne

We linked these two stories because they reveal a common theme: regulatory capture to add profits and shareholder value for the private insurers that operate Medicare Advantage. The big premium hike reflects MA lobbying power, especially in a GOP administration; the diagnostic upcoding suggests confidence that CMS will never clamp down on this misbehavior (recent efforts were beaten back, see here and here),

The overpayments are huge. The $60 B total annual cost of generous premium-setting plus over-diagnosis is 6-30 times higher than all DOGE cuts, according to estimates of true DOGE efficiencies from the American Enterprise Institute ($10 billion) and the Financial Times ($2 billion). Thus, while the Trump administration pretends to find efficiencies, it overpays insurers many times more. They don’t really care about efficiency, they care about enriching wealthy companies and individuals. (Of course, looming Medicaid cuts may reach $90 billion per year … but that’s not an “efficiency” instead a reduction in medical access and care.)

What is alarming for the future is that the Trump administration appears to be injecting new life into Medicare Advantage private insurers as a prelude to fully displacing traditional Medicare. Privatizing Medicare would have the adverse consequences of handing even more tax funds to private insurers, while increasing care costs for patients. We would lose choice of providers, forced into narrow networks and declining access to specialized services for complex medical conditions, as is frequent in MA. The model favored by current CMS leadership (Mehmet Oz) will encourage private insurers to tailor their plans for a competitive marketplace by adding benefits of limited value such as current dental, vision, and hearing care – thus appearing to offer generous benefits when, in fact, they shift costs to patients via stricter prior authorization requirements and increased claim denials. They’ll also shorten the list of medical benefits, claiming that many legitimate treatments are still experimental and lack sufficient scientific support to be covered.

Geek Notes: In the graph, appreciate the strikingly high jump from “advance” (under Biden) to “final” (under Trump) for 2026. Kronick’s estimate of $33 B due to diagnostic coding intensity is up from the $20 B previously discussed in HJM, despite being for 2021, several years out of date. In theory CMS is revising diagnostic coding practices, to reduce the overage, but such efforts have been dismally unsuccessful in the past.

About the Commentator, Jim Kahn

Jim (James G.) Kahn, MD, MPH (editor) is an Emeritus Professor of Health Policy, Epidemiology, and Global Health at the University of California, San Francisco. His work focuses on the cost and effectiveness of prevention and treatment interventions in low and middle income countries, and on single payer economics in the U.S. He has studied, advocated, and educated on single payer since the 1994 campaign for Prop 186 in California, including two years as chair of Physicians for a National Health Program California.

See All PostsYou might also be interested in...

Recent and Related Posts

Public Provisioning of Services: Adjunct to Single Payer