Demystifying Single Payer

Resources for understanding US health care and how to fix it.

Latest Posts

- Laying out the Ill-Effects of Medicaid Cuts in the Congressional Budget BillJune 27, 2025A new analysis reviewing all evidence regarding the likely impact of proposed Congressional Medicaid cuts quantifies the dire consequences of slashing coverage. About 7 million individuals will become uninsured, >2 million will skip care, and annual deaths will increase by 8-24 thousand.

- Public Provisioning of Services: Adjunct to Single PayerJune 19, 2025

- Health Reform Review: What’s Breaking, & Breaking ThroughJune 11, 2025

- Saturday! National Day of Action for Single PayerMay 29, 2025

- Veterans Care Under AttackMay 26, 2025

Ai-Chat

Ask questions and have full conversations with HJM, powered by artificial intelligence!

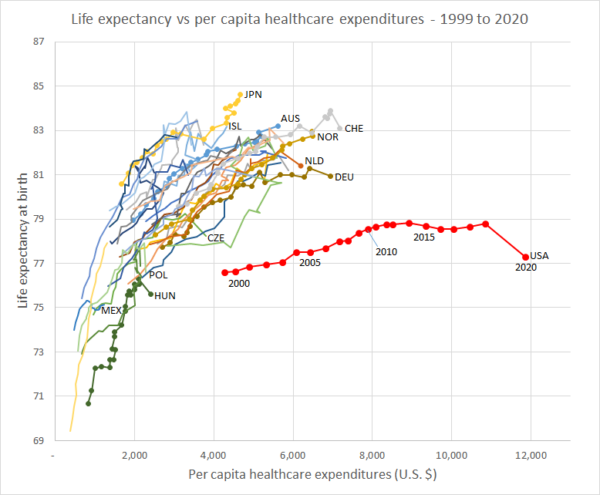

Life Expenctancy vs. Per Capita Healthcare Expenditures (1999 – 2020)

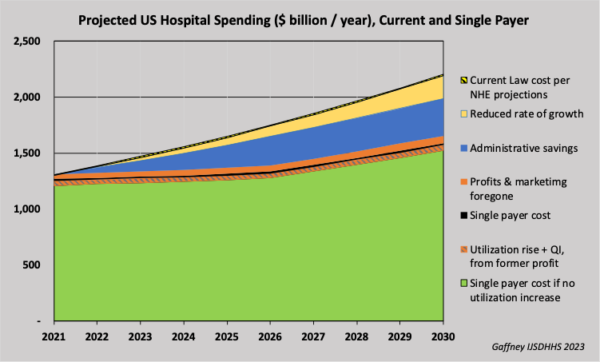

Life Expenctancy vs. Per Capita Healthcare Expenditures (1999 – 2020) Projected U.S. Hospital Spending, Current and Single Payer (2021-2030)

Projected U.S. Hospital Spending, Current and Single Payer (2021-2030)