Demystifying Single Payer

Resources for understanding US health care and how to fix it.

Latest Posts

- Premier Medical Journal Scrutinizes Corporatization of US Health CareJuly 4, 2025The highly regarded New England Journal of Medicine just launched a series on the corporatization of US health care. Today’s for-profit health care conglomerates combine insurance, care delivery, and pharmaceuticals to serve the interests of shareholders over patients. On July 4th, it is appropriate to envision our independence from corporate control.

- Laying out the Ill-Effects of Medicaid Cuts in the Congressional Budget BillJune 27, 2025

- Public Provisioning of Services: Adjunct to Single PayerJune 19, 2025

- Health Reform Review: What’s Breaking, & Breaking ThroughJune 11, 2025

- Saturday! National Day of Action for Single PayerMay 29, 2025

Ai-Chat

Ask questions and have full conversations with HJM, powered by artificial intelligence!

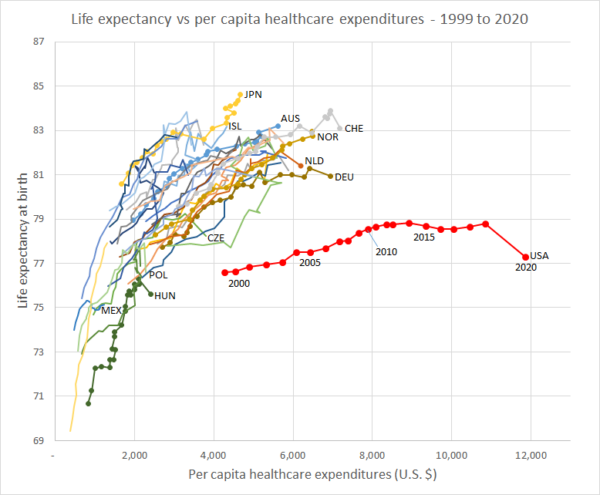

Life Expenctancy vs. Per Capita Healthcare Expenditures (1999 – 2020)

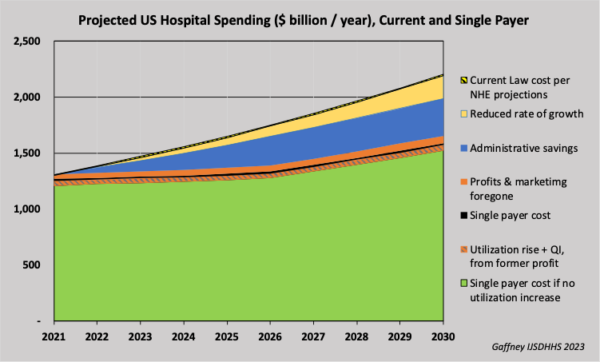

Life Expenctancy vs. Per Capita Healthcare Expenditures (1999 – 2020) Projected U.S. Hospital Spending, Current and Single Payer (2021-2030)

Projected U.S. Hospital Spending, Current and Single Payer (2021-2030)